Have Questions? Contact Us.

Since its inception, NYCLA has been at the forefront of most legal debates in the country. We have provided legal education for more than 40 years.

YANN GERON, as Chapter 7 Trustee of the Estate of Thelen LLP,

Plaintif-Appellant,

–v. –

SEYFARTH SHAW LLP,

Defendant-Respondent.

ON APPEAL FROM THE QUESTIONS CERTIFIED BY THE U.S. COURT OF APPEALS FOR THE SECOND CIRCUIT IN DOCKET NO. 12-4138-BK

IN THE MATTER OF: COUDERT BROTHERS LLP,

Debtor.

DEVELOPMENT SPECIALISTS, INC.,

Plaintiff-Respondent-Appellant.

GEOFFROY DE FOESTRAETS, JINGZHOU TAO,

Defendants.

– and –

K&L GATES LLP, MORRISON & FOERSTER LLP,

Defendants-Appellants-Respondents.

JONES DAY, ARENT FOX LLP, DLA PIPER LLP, DORSEY &WHITNEY LLP, DECHERT LLP, SHEPPARD MULLIN RICHTER &HAMPTON, LLP, SCOTT JONES, DUANE MORRIS LLP, AKIN GUMPSTRAUSS HAUER & FELD, LLP,

Defendants-Appellants-Respondents.

ON APPEAL FROM THE QUESTION CERTIFIED BY THEUNITED STATES COURT OF APPEALS FOR THE SECOND CIRCUIT INDOCKET NO. 12-4916-BK(L)

[PROPOSED] AMICI CURIAE BRIEF OF THE NEW YORK STATE BAR ASSOCIATION, THE ASSOCIATION OF THE BAR OF THE CITY OF NEW YORK, AND THE NEW YORK COUNTY LAWYERS’ ASSOCIATION

| GLENN LAU-KEE

President-Elect NEW YORK STATE BAR ASSOCIATION 1 Elk Street Albany, NY 12207 (518) 463-3200 |

DAMIAN SCHAIBLE

Chair, Committee on Bankruptcy andCorporate Reorganization THE ASSOCIATION OF THE BAR OFTHE CITY OF NEW YORK 42 West 44th Street New York, NY 10036 (212) 382-6600 |

| BARBARA MOSES

President NEW YORK COUNTY LAWYERS’ ASSOCIATION 14 Vesey Street New York, NY 10007 (212) 267-6646 |

The New York State Bar Association, The Association of the Bar of the City of New York (also known as the New York City Bar Association), and the New York County Lawyers’ Association state that they have no parent corporations, subsidiaries or affiliates other than as follows:

The New York State Bar Association has an affiliate named The New York Bar Foundation.

The New York City Bar Association has an affiliate named Association of the Bar of the City of New York Fund, Inc.

The New York County Lawyers’ Association has an affiliate named The New York County Lawyers Association Foundation, Inc.

| TABLE OF CONTENTS | Page(s) |

| TABLE OF AUTHORITIES | ii |

| INTEREST OF AMICI CURIAE | 1 |

| QUESTIONS PRESENTED | 3 |

| ARGUMENT | 4 |

| INTRODUCTION | 4 |

| I. APPLYING THE UNFINISHED BUSINESS DOCTRINE TOHOURLY FEE MATTERS CONFLICTS WITH ESTABLISHEDNEW YORK LAW REGARDING THE APPLICATION OF THATDOCTRINE TO CONTINGENCY FEE MATTERS | 7 |

| II APPLYING THE UNFINISHED BUSINESS DOCTRINE TO HOURLY FEE MATTERS CONFLICTS WITH BASIC PRINCIPLES THAT GOVERN THE ATTORNEY-CLIENT RELATIONSHIP UNDER NEW YORK LAW AND THE RULES OF PROFESSIONAL CONDUCT | 12 |

| CONCLUSION | 21 |

| TABLE OF AUTHORITIES | |

| Page(s) | |

| CASES | |

| In re Brobeck, Phleger& Harrison LLP,

408 B.R. 318 (N.D. Cal. 2009) |

16 |

| Campagnola v. Mulholland, Minion & Roe,

76 N.Y.2d 38 (1990) |

13 |

| Cohen v. Lord, Day & Lord,

75 N.Y.2d 95 (1990) |

14,15,16,17 |

| Crowley v. Wolf,

281 N.Y. 59 (1939) |

13 |

| Demov, Morris, Levin &Shein v. Glantz,

53 N.Y.2d 553 (1981) |

12,13 |

| Denberg v. Parker Chapin Flattau&Klimpl,

82 N.Y.2d 375 (1993) |

15,16 |

| Development Specialists, Inc. v. Akin Gump Strauss Hauer& Feld LLP,

480 B.R. 145 (S.D.N.Y. 2012) |

14, 15 |

| Geron v. Robinson & Cole LLP,

476 B.R. 732 (S.D.N.Y. 2012) |

.5, 11, 14 |

| Grantv. Heit,

263 A.D.2d 388 (1st Dep’t 1999) |

7,8,10 |

| In re Heller Ehrman LLP,

No. 08-32514DM, 2013 WL 951706 (Bankruptcy Court, N.D. Cal. March 11, 2013) |

16,20 |

| Jewel v. Boxer,

156 Cal. App. 3d 171 (1984) |

5, 12, 16, 20 |

| Kirschv. Leventhal,

181 A.D.2d 222 (3d Dep’t 1992) |

7, 8,9 |

| Lai Ling Cheng v. Modansky Leasing Co., Inc.,

73 N.Y.2d 454 (1989) |

10 |

| Liddle, Robinson & Shoemaker v. Shoemaker,

304 A.D.2d 436 (1st Dep’t 2003) |

9 |

| Martin v. Camp,

219 N.Y. 170(1916) |

13, 14 |

| Mid-Island Hosp., Inc. v. Empire Blue Cross & Blue Shield (In re Mid-Island Hosp., Inc.),

276 F.3d 123 (2d Cir. 2002) |

8 |

| Murov v. Ades,

12 A.D.3d 654 (2d Dep’t 2004) |

9,10 |

| Musso v. Ostashko,

468 F.3d 99 (2d Cir. 2006) |

8 |

| Santalucia v. Sebright Transp., Inc.,

232F.3d 293 (2d Cir. 2000) |

9,10 |

| Schneider, Kleinick, Weitz, Damashek& Shoot v. City of New York,

302 A.D.2d 183 (1st Dep’t 2002) |

10 |

| Shandell v. Katz,

217 A.D.2d 472 (1st Dep’t 1995) |

9 |

| Shaw v. Manufacturers Hanover Trust Co.,

68 N.Y.2d 172 (1986) |

113 |

| Sheresky v. Sheresky Aronson Mayefsky& Sloan,

2011 N.Y. Mise. LEXIS 6588 (N.Y. Sup. Ct, N.Y. Co, Sept. 13, 2011) |

11, 12, 19 |

| Shiboleth v. Yerushalmi,

58 A.D.3d 407 (1st Dep’t 2009) |

9,10 |

| Stem v. Warren,

227 N.Y. 538 (1920) |

14 |

| Teichner v. W & J Holsteins, Inc.,

64 N.Y.2d 977 (1985) |

13 |

| STATUTES AND CODES | |

| Uniform Partnership Act | 5 |

| United States Bankruptcy Code, Section 541 | 7,8 |

| Partnership Law §73 | 10 |

| RULES AND REGULATIONS | |

| New York Rules of Professional Conduct | |

| Rule 1.5(g) | 18,19 |

| Rule 1.16(b)(3) | 17 |

| Rule 1.16(d) | 18 |

| Rule 1.16(e) | 18 |

| Rule 5.6 | 16 |

| Rule 5.6(a) | 16,17 |

| OTHER AUTHORITIES | |

| Collier on Bankruptcy § 541.07 | 8 |

| Constitution of The Association of the Bar of the City of New York, art. II | 1,2 |

INTEREST OF AMICI CURIAE

The New York State Bar Association (the “State Bar”), founded in 1876, is the oldest and largest voluntary state bar organization in the nation, with a membership of more than 75,000 lawyers representing every town, city, and county in the state. Since its inception, the State Bar has played a key role in cultivating the science of jurisprudence, promoting reform in the law, facilitating the administration of justice, and elevating the standards of integrity, honor, professional skill, and courtesy in the legal profession. For more than 35 years, the State Bar has represented, through its Executive Committee, its House of Delegates and its numerous Sections and Committees, the state-wide voice of lawyers and the profession on all matters and policies governing the professional conduct of lawyers. Specifically, the State Bar has numerous Committees that address issues of attorney ethics and professionalism, in the form of proposed changes to the New York Rules of Professional Conduct, ethics opinions, reports, CLEs and symposia. Moreover, in April 2011, the State Bar issued its Report on the Future of the Legal Profession which, among other things, focused on the importance of lawyers and law firms meeting client demands and providing client service in an increasingly fluid and competitive environment. This amicus brief, which has been approved by the State Bar Executive Committee, was sponsored primarily by the Bankruptcy Committee of the Business Law Section, whose members range from solo to large firm practitioners throughout New York State, and represent clients on a wide variety of corporate, transactional and litigation matters.

The Association of the Bar of the City of New York (“New York City Bar”), founded in 1870, is a voluntary association of lawyers, judges and law students. Today, the New York City Bar has more than 23,000 members. Its purposes include “cultivating the science of jurisprudence, promoting reforms in the law, facilitating and improving the administration of justice, [and] elevating the standard of integrity, honor and courtesy in the legal profession.” (Constitution of The Association of the Bar of the City of New York, Art. II.) The New York City Bar has 150 committees that focus on different legal practice areas and issues. Through amicus briefs, testimony, reports, statements, and letters drafted by committee members, the New York City Bar comments on questions of law and public policy. This amicus brief was sponsored and principally drafted by the Committee on Bankruptcy and Corporate Reorganization, which focuses on issues relevant to corporate and individual bankruptcies and corporate out-of-court restructurings, and includes practitioners who represent debtors and creditors in bankruptcy and reorganization proceedings. This brief was approved by that Committee and by the President of the New York City Bar.

The New York County Lawyers’ Association (“NYCLA”) is a not-for-profit membership organization of 9,000 members committed to applying their knowledge and experience in the field of law to the promotion of the public good and ensuring access to justice for all. Among its many activities, NYCLA has created the Ethics Institute, which coordinates all ethics and professionalism- related activities of the Association, engages in independent research and scholarship regarding professional responsibility issues, drafts ethics opinions, and furthers lawyer professionalism through its Professionalism Task Force. This amicus brief has been sponsored by the Ethics Institute, and approved by the NYCLA Executive Committee and the NYCLA Board of Directors.

Combined, the State Bar, the New York City Bar and NYCLA (the “Tri-Bar Amici”) bring together many different perspectives on the realities of modern law practice. The Tri-Bar Amici file this joint brief to emphasize the significance of the issues that this Court has been asked to decide in these two cases in which identical questions have been certified to this Court – issues that implicate the very meaning of the attorney-client relationship, as well as the important values of client choice and lawyer autonomy that stand as the bedrock of our profession’s relationship with the clients we serve and the public in general.

In December 2013, this Court accepted from the Second Circuit Court of Appeals identical certified questions (set forth below) arising in two different federal bankruptcy cases: In re Coudert Brothers LLP and In re Thelen LLP. We understand that the two cases have been consolidated for argument.

QUESTIONS PRESENTED

Under New York law, is a client matter that is billed on an hourlybasis the property of a law firm, such that, upon dissolution and in related bankruptcy proceedings, the law firm is entitled to the profit earned on such matters as the “unfinished business” of the firm?

THE TRI-BAR AMICI RESPECTFULLY SUBMIT THAT THE ANSWER TO THIS QUESTION SHOULD BE “NO.”

If so, how does New York law define a “client matter” for purposes of the unfinished business doctrine and what proportion of the profit derived from an ongoing hourly matter may the successor law firm retain?

BECAUSE OF THEIR ANSWER TO THE FIRST QUESTION, THE TRI- BAR AMICI WILL NOT ADDRESS THIS QUESTION.

ARGUMENT

INTRODUCTION

The first question certified to this Court presents an issue of first impression for a New York appellate court and raises important public policy concerns that transcend the facts of this particular case. The issue is whether the controversial “unfinished business” doctrine should apply to hourly fee matters under New York law. The Tri-Bar Amici respectfully submit that it should not. Applying the doctrine to hourly fee matters improperly treats the clients of a dissolving law firm as property of the firm, devalues the attorney-client relationship, and subordinates the interests of its clients to those of its creditors. These consequences conflict with New York law and public policy, as embodied in judicial decisions and the New York Rules of Professional Conduct.

The unfinished business doctrine as applied to law firms came to prominence in an interlocutory ruling by an intermediate court in California, Jewel v. Boxer, 156 Cal. App. 3d 171 (1984). Jewel involved a dissolving four-partner firm without a written partnership agreement. Under the Uniform Partnership Act, absent a partnership agreement to the contrary, any withdrawal of a partner is deemed a dissolution. In Jewel, the court concluded that the former partners were entitled to an allocation of profits from contingency fee engagements pending at the time of dissolution in proportion to their interests in the partnership. The court reasoned that under the Uniform Partnership Act, partners have a fiduciary duty to complete the partnership’s unfinished business without receiving additional compensation for doing so, and that pending contingency matters constituted “unfinished business” within the meaning of the statute.

The Jewel court did not address bankruptcy law or creditors’ remedies. Over time, however, courts in California and elsewhere have applied the doctrine as a remedy in bankruptcy and held that “unfinished business” was property of the estate which belongs to its creditors. In that context, the doctrine benefits the dissolved law firm’s creditors to the detriment of the firm’s former clients and the overall attorney-client relationship. As a result, the doctrine undermines the attorney-client relationship in violation of basic principles governing client rights and attorney obligations under New York law.

If interpreted as treating attorney-client engagements as “property,” the unfinished business doctrine would conflict with the cardinal principle of “client choice” – a client’s unilateral right to change lawyers and law firms at any time or to continue to retain existing counsel. Additionally, because the “unfinished business” doctrine applies only post-dissolution, applying the doctrine to law firms would encourage partners in a struggling firm to “jump ship” before the firm reaches the point of dissolution, potentially hastening the demise of firms that might otherwise survive. As a result, clients of struggling firms would be more likely to suffer problematic interruptions in representation. The doctrine also would discourage a dissolved firm’s partners from diligently continuing representation of clients ’ pending matters because of the risk that future profits generated by those matters will be allocated to the dissolved firm’s creditors. Similarly, the doctrine would discourage other law firms from accepting the dissolved firm’s partners and their engagements, thereby further disrupting client representation. All of these effects would be inconsistent with the fundamental principles of client choice and lawyer mobility established by New York case law, ethics rules and public policy.

I.

APPLYING THE UNFINISHED BUSINESS DOCTRINE TO HOURLY FEE MATTERS CONFLICTS WITH ESTABLISHED NEW YORK LAW REGARDING THE APPLICATION OF THAT DOCTRINE TO

CONTINGENCY FEE MATTERS

In the Second Circuit, representatives of the Thelen bankruptcy estate (the “Thelen Estate”) argued that the unfinished business doctrine already governs contingent fee matters under New York law, and that the doctrine should be extended to hourly fee matters, because there is no relevant difference between the two types of engagements. The representatives of the Coudert Brothers estate (the “Coudert Estate”) advanced the same position. This argument misconstrues New York law on how contingent fees are divided between a dissolving firm and successor counsel, as recognized, for example, in Grant v. Heit, 263 A.D.2d 388 (1st Dep’t 1999) and Kirschv. Leventhal, 181 A.D.2d 222 (3d Dep’t 1992).

The unfinished business doctrine in the context of a law firm bankruptcy rests on the following propositions: (1) partners who leave a law firm at the time it dissolves have a fiduciary duty to complete pending client engagements for the firm’s benefit; (2) that duty is enforceable by the firm itself or by its successor, i.e., the bankruptcy estate or trustee (collectively, “the estate”); (3) the right to enforce that duty constitutes property of the estate; and (4) whenever other firms receive fees as a result of taking on a departing partner with pending engagements, they receive “property” that belongs to the estate and is subject to being recovered under fraudulent conveyance or other principles.

Thus, the threshold question confronting this Court is whether the Coudert Estate and the Thelen Estate each has a continuing property interest under New York law in the firm’s client hourly fee engagements following the firm’s dissolution.

What constitutes “property” of the estate in the bankruptcy context must be determined by state law principles. The Bankruptcy Code does not create property rights; it simply gives effect to those rights insofar as they are recognized by state law. See, e.g., Musso v. Ostashko, 468 F.3d 99, 105 (2d Cir. 2006) (“Whether the debtor has a legal or equitable interest in property such that it becomes ‘property of the estate’ under [Bankruptcy Code] section 541 is determined by applicable state law.”); Mid-Island Hosp., Inc.v. Empire Blue Cross & Blue Shield (In re MidIsland Hosp., Inc.), 276 F.3d 123, 128 (2d Cir. 2002) (the estate’s legal and equitable interests in property are “determined by state law”).

As cases such as Grant and Kirsch demonstrate, under New York law when a contingent fee matter moves from one firm to another following dissolution of the first firm, there is no presumption that all profits generated by the engagement go to the first firm. Rather, New York law entitles the first firm to keep only the value of the case at the time of the dissolution, determined on a quantum meruitbasis, while the second firm gets the balance of the case’s value. Thus, both firms get to keep the portion of the legal fees they actually earn. The Thelen and Coudert Estates nevertheless argue, in effect, that the first firm maintains an enduring ownership interest in all the work on the client engagement even after the client has chosen (out of necessity, if the law firm is dissolved and in bankruptcy) to go elsewhere so that the engagement can be completed. That result cannot be squared with New York law governing contingent fee matters. It also cannot be squared with New York law and public policy governing the attorney-client relationship, as discussed in Point II below.

Santaluciav. Seabright Transp., Inc., 232 F.3d 293 (2d Cir. 2000) succinctly sets forth in one place the principles applicable to contingent fee matters in New York: A dissolved firm’s property interest in contingent fees received by a subsequent firm is limited to the amount owed by the client for services previously rendered by the dissolved firm. 232 F.3d at 298. There is no precedent for the proposition asserted by the Coudert and Thelen Estates that the first firm, now defunct, has a right to a portion of the fees for services subsequently rendered by the second firm. Indeed, as noted, Santalucia correctly summarized New York law, that “the dissolved firm is entitled only to the value of the case at the date of dissolution, with interest.” 232 F.3d at 297-98 (citing Shandell v. Katz, 217 A.D.2d 472 (1st Dep’t 1995), and Kirsch v. Leventhal, 181 A.D.2d 222 (3d Dep’t 1992)); see also Shiboleth v. Yerushalmi, 58 A.D.3d 407, 408 (1st Dep’t 2009); Murovv. Ades, 12 A.D.3d 654, 655-56 (2d Dep’t 2004) (“That is not to say, however, that the full fees ultimately received as a result of collections on these judgments must be remitted to the dissolved firm”) (citing Santalucia and Kirsch); Liddle, Robinson &Shoemakerv. Shoemaker, 304 A.D.2d 436, 441 (1st Dep’t 2003) (a withdrawing partner was not entitled to a full partnership share of the contingent fee ultimately received but only “a portion” of the fee, namely, “the value of his interest at the date of dissolution . . . with interest,” or alternatively, “in lieu of interest, the profits attributable to the use of his right in the property of the dissolved partnership” pre-dissolution) (quoting Partnership Law § 73).

Proper allocation of fees between firms in the context of a contingent fee matter requires an evaluation of “the efforts undertaken by the former law firm prior to the dissolution date, or any other relevant evidence to form a conclusion as to the value of these cases to the law firm on the dissolution date.” Grant, 263 A.D.2d at 389; see also Shiboleth, 58 A.D.3d at 408. “[T]he lawyer must remit to his former firm the settlement value, less that amount attributable to the lawyer’s efforts after the firm’s dissolution.” Santalucia, 232 F.3d at 298; see also Murov, 12 A.D.3d at 656 (it is proper to “deduct the amounts attributable to the [departing partner]’s post-dissolution efforts, skill, and diligence”). The subsequent firm’s entitlement, in the contingent context, to compensation for “post-dissolution efforts, skill and diligence” ensures the client’s ability to retain and compensate successor counsel, unaffected by the prior firm’s dissolution. The allocation reflects the more general principle that neither law firm “owns” the client or the engagement, and that each firm is entitled to be paid only for services it actually rendered.

In contrast, the Thelen and Coudert Estates have argued, at least in the hourly context, that their property interest extends not merely to fees actually earned by Thelen or Coudert, as the case may be, for work they actually performed, but rather to all profits for the entire engagement, irrespective of how much time Thelen or Coudert invested and how much time the subsequent firm invested – or, for that matter, how much Thelen or Coudert had already been paid. To illustrate, assume that a client engaged Thelen on an hourly basis to handle a business transaction and paid it $10,000, but Thelen dissolved while the transaction was in its early stages, and the responsible partner moved to law firm Smith & Jones LLP. Assume further that the client then engaged Smith & Jones LLP (also on an hourly basis) and paid it $90,000 to complete the matter. The Thelen Estate would argue that its property includes the entire $90,000, less only the costs incurred by Smith & Jones LLP – in other words, all of the profits the latter firm earned from the engagement. In Thelen, Judge Pauley correctly held that acceptance of the Estate’s argument would create a property right not merely in earned fees but in the client engagement itself, a right not recognized by New York law and repugnant to New York public policy. See Geron,476 B.R. at 740.

The sole New York state court case to address this issue in the hourly context, Sheresky v. Sheresky Aronson Mayefsky& Sloan, No. 150178/10, 2011 N.Y. Misc. LEXIS 6588, at *13-14 (N.Y’. Sup. Ct, N.Y. Co, Sept. 13, 2011), reached the same conclusion as Judge Pauley. Although the Sheresky court referred to the “unfinished business” doctrine in its reasoning, it concluded that extending that doctrine to hourly fee matters would lead to improper and unfair results: “[T]o the extent that compensation for the case is based solely on the amount of hourly work performed post-dissolution, compensating a former partner out of that fee would reduce the compensation of the attorneys performing the work.” Id. at * 14. Thus, the Sheresky court’s reasoning as to hourly cases is consistent with all the New York cases cited above regarding the post-dissolution division of contingent fees (and is inconsistent with Jewel v. Boxer).

II.

APPLYING THE UNFINISHED BUSINESS DOCTRINE TO HOURLY FEEMATTERS CONFLICTS WITH BASIC PRINCIPLES THAT GOVERN THE ATTORNEY-CLIENT RELATIONSHIP UNDER NEW YORK LAW

AND THE RULES OF PROFESSIONAL CONDUCT

As a general matter, a client has the unfettered right to hire and fire counsel at any time. The client’s fundamental right to choose counsel is “well rooted” in New York jurisprudence. Demov, Morris, Levin &Shein v. Glantz, 53 N.Y.2d 553, 556 (1981). This freedom of choice is essential to maintaining a relationship in which the client places “utmost trust and confidence” in the attorney:

The unique relationship between an attorney and client, founded in principle upon the elements of trust and confidence on the part of the client and of undivided loyalty and devotion on the part of the attorney remains one of the most sensitive and confidential relationships in our society. A relationship built upon a high degree of trust and confidence is obviously more susceptible to destructive forces than are other less sensitive ones. It follows, then, that an attorney cannot represent a client effectively and to the full extent of his or her professional capability unless the client maintains the utmost trust and confidence in the attorney.

Id.

This essential element of the attorney-client relationship should not be subordinated to creditors’ interests, as advocated by the Thelen and Coudert Estates. Under settled New York law, the attorney-client relationship is terminable at will by the client — not the lawyer — at any time, for any reason. A client’s right to terminate the relationship is “absolute” and cannot be restricted for the benefit of the attorney or the attorney’s law firm. See, e.g., Campagnolav.Mulholland, Minion & Roe, 76 N.Y.2d 38, 43 (1990); Shaw v. Manufacturers Hanover Trust Co., 68 N.Y.2d 172, 177 (1986); Teichner v. W & J Holsteins, Inc., 64 N.Y.2d 977, 979 (1985), lv denied 70 N.Y.2d 606 (1987); Demov, 53 N.Y.2d at 556-57; Crowley v. Wolf, 281 N.Y. 59, 64-65 (1939); Martin v. Camp, 219 N.Y. 170, 176 (1916), rearg denied 221 N.Y. 631 (1917).

It follows from this principle that law firms cannot claim a continuing property right to compensation from client engagements once the client has chosen to move the engagement elsewhere. Client engagements cannot be bartered or sold or assigned to the highest bidder. Reducing client engagements to the status of inventory items demeans both clients and the legal profession. Treating a client’s “unfinished business” as the property of a dissolved firm would undermine the special trust and confidence that clients place in their attorneys and the special duties attorneys owe their clients. The unfettered power of clients to move engagements is especially important in the dissolution context, where the incumbent firm is unable to fulfill its professional obligations. Application of the “unfinished business” doctrine creates an economic drag, thus disincentivizing other law firms from accepting lawyers and engagements from dissolved firms.

It is precisely because the principle of client choice is so ingrained in New York’s jurisprudence that courts routinely reject financial arrangements between partners that prevent – or even merely inhibit – a lawyer’s ability to move from one firm to another. In the leading case of Cohen v. Lord, Day & Lord, 75 N.Y.2d 95 (1989), this Court invalidated the provision in a law firm’s partnership agreement that conditioned a departing partner’s receipt of a withdrawal payment on his refraining from competing with the firm after he left. Although the partner remained free to join another firm and represent former Lord Day & Lord clients, the Court found that the financial burden imposed would discourage him from doing so, and thus conflicted with the paramount New York public policy favoring client choice. New York law is clear: Even indirect financial restraints on lawyer mobility harm clients and are therefore prohibited. Id. at 98; see also Denberg v. Parker Chapin Flattau&Klimpl, 82 N.Y.2d 375, 380-81 (1993) (“restrictions on the practice of law, which include ‘financial disincentives’ against competition … are objectionable primarily because they interfere with the client’s choice of counsel”).

The unfinished business doctrine imposes just such restraints. In Coudert, Judge McMahon concluded that Cohen and Denberg are distinguishable because they did not address the unfinished business doctrine, “are not dissolution cases,” and involved ongoing competition between two active firms. Denberg was also distinguished on the ground that it involved a fee sharing provision with respect to new business as well as old, “in effect treating the client, not the matter, as the firm’s property.” Development Specialists, 480 B.R. at 171-72 (emphasis in original). But this Court’s rulings in the Cohen and Denberg cases relied upon a principled analysis of clients’ rights, and their teachings cannot be so narrowly boxed in. As shown herein, however, the unfinished business doctrine improperly treats clients as property and impairs client interests even with respect to “old” matters that are transferred from a dissolved firm. Moreover, it imposes this as a default provision in every partnership agreement. Thus, the principles of client choice enunciated in Cohen and Denberg must remain controlling in this context.

The unfinished business doctrine conflicts with New York public policy as embodied in the New York Rules of Professional Conduct in at least three ways.

First, the doctrine conflicts with the public policy embodied in Rule 5.6(a), which prohibits restraints on lawyer mobility in the interest of protecting client choice. The Rule bars lawyers from participating in “[any] type of agreement that restricts the right of a lawyer to practice after termination of the relationship.” Such restrictions are improper because they limit “the freedom of clients to choose a lawyer,” as well as a lawyer’s “professional autonomy.” Rule 5.6, Comment 1. A lawyer’s freedom to move from one firm to another safeguards a client’s ability to retain counsel of his or her choice and the lawyer’s ability to continue zealous representation of that client. The unfinished business doctrine creates perverse incentives that undermine these objectives by limiting client choice and disrupting client services.

In particular, the doctrine would encourage partners to abandon a struggling law firm to beat the start of any dissolution or insolvency clock. The doctrine would also discourage lawyers in a dissolving firm from acting diligently to serve clients whose matters may be subject to unfinished business claims. Similarly, the doctrine would discourage other law firms from accepting lawyers and client engagements from a dissolved firm because the resulting profits will be subject to claims by the dissolved firm and its creditors. And giving effect to the unfinished business doctrine could trigger the inevitable slippery slope – why not apply the same principle when a partner leaves before dissolution (which would of course contradict this Court’s holding in Cohen)? All of these effects would be detrimental to clients and the profession as a whole. When lawyers must confront the Scylla of abandoning their clients or the Charybdis of losing future compensation on hourly fee matters, both clients and lawyers suffer. New York law and public policy seek to avoid such results.

Second, as discussed above, the doctrine contravenes the long-established public policy favoring a client’s right to discharge an attorney and the attorney’s obligation to abide by the client’s decision. Rule 1.16(b)(3) imposes on a lawyer an absolute obligation to withdraw from the attorney-client relationship whenever “the lawyer is discharged.” Even if the client discharges the attorney “unfairly,” the attorney must withdraw and “must take all reasonable steps to mitigate the consequences to the client” of the withdrawal. Rule 1.16, Comment 9 (citing Rule 1.16(e)). RPC 1.16 thus preserves the client’s fundamental right to choose counsel unilaterally and without restraint, even at the expense of a law firm’s profits. As applied to hourly fee engagements, the unfinished business doctrine conflicts with this essential public policy.

Third, application of the unfinished business doctrine to hourly fee matters would conflict with a lawyer’s obligations under Rule 1.5(g). In relevant part, the Rule prohibits fee splitting without client consent unless “the division is in proportion to the services performed by each lawyer,” or unless “each lawyer assumes joint responsibility for the representation” in a writing given to the client. The claims of the Coudert and Thelen Estates for profits on all unfinished business violate these provisions. The Estates are not seeking an allocation of fees “in proportion to the services” that the law firms provided while they were operating – indeed, as shown above, they seek a disproportionate allocation of fees. Moreover, the Estates are obviously not planning to assume “joint responsibility” for any future representation. As the Sheresky court noted, Rule 1.5(g) precludes an unfinished business claim by a partner in a dissolved law firm against his fellow partners. For that reason and others, the Sheresky court specifically declined “to recognize a cause of action for unfinished business for hourly fee cases which has, hitherto, not been recognized by New York courts.” Sheresky, 2011 N.Y. Misc. LEXIS 6588, at *15. The same conclusion should prevail here.

There is one final point: the application of the unfinished business doctrine to hourly cases, and the resulting restriction on client choice and lawyer autonomy, strike at the values of professionalism so important to the Tri-Bar Amici. In a Task Force Report on Professionalism issued in 2010, NYCLA relied on a definition of professionalism propounded by Dean Roscoe Pound and cited in the Report of the ABA’s Commission on Professionalism, “… In the Spirit of Public Service: A Blueprint for the Rekindling of Lawyer Professionalism ” (1986). Dean Pound stated, in pertinent part:

Professionalism requires adherence to the highest standards of integrity and a willingness to subordinate narrow self-interest in pursuit of the more fundamental goal of client service. Because of the tremendous power they wield in our system, lawyers must never forget that their duty to serve their clients fairly and skillfully takes priority over the personal accumulation of wealth. Lawyers must be willing and prepared to undertake zealous advocacy on behalf of their clients while retaining enough perspective to provide those clients with considered, well-informed and objective advice.

NYCLA 2010 Report at 9 (emphasis added) (citation omitted).

Instead of putting client interests first, application of the unfinished business doctrine to hourly cases puts them last: behind the interests of the dissolving firm’s creditors and former partners. It places significant economic pressure on attorneys of the dissolving firm to abandon their clients, as those clients and their unprofitable cases become an albatross making it harder for the attorneys to find a new position. In re Heller Ehrman, 2013 WL 951706, at *7 (citing evidence of “the reluctance of other firms to take on Heller attorneys and staff in the absence of [a Jewel] waiver”). This not only deprives the clients of their lawyer of choice, but also imposes considerable additional costs on them by forcing them to hire substitute counsel.

In short, under the unfinished business doctrine, clients find themselves treated not just as financial “assets,” which is bad enough, but as collateral damage in law firm break-ups while former partners and creditors scramble for the spoils. If we are truly committed to putting our clients’ interests ahead of our own, this is the very opposite of the result we want to achieve – for our profession, our clients and the public at large.

CONCLUSION

The unfinished business doctrine would have unacceptable consequences when applied to law firms’ hourly fee engagements. In the bankruptcy context, the doctrine would elevate creditor interests over client interests. The doctrine’s perverse consequences would turn the attorney-client relationship on its head. This Court should hold that application of the unfinished business doctrine to hourly fee engagements is improper under New York law and public policy.

Dated: New York, New York

April 18,2014

Respectfully submitted,

GLENN LAU-KEE

President-Elect

NEW YORK STATE BAR ASSOCIATION

1 Elk Street

Albany, NY 12207

(518) 463-3200

DAMIAN SCHAIBLE

Chair, Committee on Bankruptcy and Corporate Reorganization

THE ASSOCIATION OF THE BAR OF THE CITY OF NEW YORK

42 West 44th Street

New York, NY 10036

(212)382-6600

BARBARA MOSES President NEW YORK COUNTY LAWYERS’ ASSOCIATION 14 Vesey Street New York, NY 10007 (212) 267-6646 Attorneys for Amicus Curiae The Tri-Bar Amici |

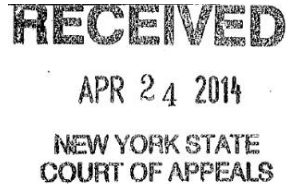

CTQ-2013-0009 and CTQ – 2013 – 0010

Court of Appeals of the State of New York

YANN GERON, as Chapter 7 Trustee of the Estate of Thelen LLP,

Plaintiff-Appellant,

– v. –

SEYFARTH SHAW LLP,

Defendant-Respondent.

ON APPEAL FROM THE QUESTION CERTIFIED BY THE UNITED STATES COURT OF APPEALS FOR THE SECOND CIRCUIT IN DOCKET NO. 12-4138-BK

IN THE MATTER OF: COUDERT BROTHERS LLP,

Debtor.

DEVELOPMENT SPECIALISTS, INC.,

Plaintiff-Respondent-Appellant.

GEOFFROY DE FOESTRAETS, JINGZHOU TAO,

Defendants.

– and –

K&L GATES LLP, MORRISON & FOERSTER LLP,

Defendants-Appellants-Respondents.

_______ _________ ________ _________ ____________

JONES DAY, ARENT FOX LLP, DLA PIPER LLP, DORSEY & WHITNEY LLP, DECHERT LLP, SHEPPARD MULLIN RICHTER & HAMPTON, LLP, SCOTT JONES, DUANE MORRIS LLP, AKIN GUMP STRAUSS HAUER & FELD, LLP,

Defendants-Appellants-Respondents.

ON APPEAL FROM THE QUESTION CERTIFIED BY THE UNITED STATES COURT OF APPEALS FOR THE SECOND CIRCUIT IN DOCKET NO. 12-4916-BK (L)

AFFIDAVIT OF SERVICE

STATE OF NEW YORK )

) ss.:

COUNTY OF NEW YORK)

Hayley T. Allis, being duly sworn, deposes and says: I am over 18 years of age, not a party to this action, and employed by the law firm of Pillsbury Winthrop Shaw Pittman LLP.

On April 22, 2014, I served the following:

Notice of Motion and Supporting Memorandum of the New York State Bar Association, the Association of the Bar of the City of New York, and the New York County Lawyers’ Association for Leave to File an Amici Curiae Brief, dated April 22, 2014,

[Proposed] Amici Curiae Brief of the New York State Bar Association, the Association of the Bar of the City of New York, and the New York County Lawyers’ Association, dated April 18, 2014

upon the parties herein by enclosing true copies thereof in sealed properly addressed postage paid First Class Mail envelopes, deposited into the exclusive care and custody of the United States Postal Service within the State of New York addressed to:

|

Rich Michaelson Magaliff Moser, LLP Howard P. Magaliff Esq. 340 Madison Avenue, 19th Floor New York, NY 10173-1921 Attorney for Appellant Yann Geron |

Meister Seelig& Fein, LLP Jeffrey Schreiber Esq. 140 East 45th Street, 19th Floor New York, NY 10017-3144 Attorney for Appellant-Respondent DLA Piper (US) LLP |

|

Thompson Hine, LLP Thomas L. Feher Esq. 3900 Key Center 127 Public Square Cleveland OH 44114-1291 Attorney for Respondent Seyfarth Shaw LLP |

Miller &Wrubel, P.C. Joel M. Miller Esq. 570 Lexington Avenue, 25th Floor New York, NY 10022-6837 Attorney for Appellant -Respondent Dechert LLP |

|

Arent Fox, LLP Allen G. Reiter Esq. 1675 Broadway New York, NY 10019-5820 Attorney for Appellant-Respondent Arent Fox LLP |

Morrison &Foerster, LLP Brett H. Miller Esq. 1290 Avenue of the Americas New York, NY 10104-0101 Attorney for Appellant-Respondent Morrison & Foerster LLP |

|

Jones Day Shay Dvoretzky Esq. 51 Louisiana Avenue, NW Washington DC 20001-2113 Attorney for Appellant-Respondent Jones Day |

Quinn Emanuel Urquhart & Sullivan, LLP Susheel Kirpalani Esq. 51 Madison Avenue, 22nd Floor New York, NY 10010-1603 Attorney for Appellant-Respondent Akin Gump Strauss Hauer & Feld LLP |

|

Jones Day Geoffrey S. Stewart Esq. 222 East 41st Street New York, NY 10017 Attorney for Appellant-Respondent Scott Jones |

Sheppard Mullin Richter & Hampton, LLP Daniel L. Brown Esq. 30 Rockefeller Plaza, 39th Floor New York, NY 10112-0015 Attorney for Appellant-Respondent Sheppard Mullin Richter & Hampton, LLP |

|

K & L Gates, LLP Richard S. Miller Esq. 599 Lexington Avenue New York, NY 10022-6030 Attorney for Appellant-Respondent K&L Gates LLP |

McCarter & English LLP David Adler, Esq. 245 Park Avenue, 27th Floor New York, NY 10167 Attorneys for Respondent Development Specialists, Inc.

|

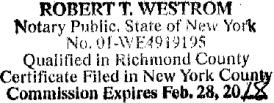

Sworn to before me this

22nd day of April, 2014

Notary Public

Footnotes:

1 Certain members of the State Bar, the New York City Bar and NYCLA practice at firms that may have interests in the outcome of the two cases. None of the members responsible for preparing this brief practice at firms that have interests in the outcome of either of the certified cases. The judges and other government officials who are valued members of the relevant New York City Bar Committee, the State Bar Business Law Section or the NYCLA Ethics Institute (the “Sponsoring Committees”) did not participate in the preparation of this brief. In addition, this brief does not necessarily reflect the individual views of all of the members of the Sponsoring Committees or any institutions with which such members are associated.

2 When Jewel was decided, both the New York and California partnership statutes were based on the Uniform Partnership Act. That is no longer the case in California, but it remains so in New York.

3 The U.S. District Court in the Thelen case applied New York rather than California law based on a choice-of-law analysis tied to the particular facts presented here. See Geron v. Robinson &Cole LLP,476 B.R. 732, 737-78 (S.D.N.Y. 2012). This brief does not address the choice-of-law issue. We focus instead on the broader issues of law and public policy raised by the unfinished business doctrine insofar as it applies under New York law. The Coudert case involves New York law and no conflict of law issue is presented.

4 Section 541 of the Bankruptcy Code defines the “estate” as consisting of “all legal or equitable interests of the debtor in property as of the commencement of the case” (subject to certain exceptions). In many cases (including this one), the law firm has shut down and dissolved by the time it enters bankruptcy. In theory, however, any claim owned by the debtor as of the petition date would vest as “property” of the estate. Collier on Bankruptcy § 541.07.

5 This is entirely consistent with the long-standing New York rule that applies to the more common situation of a contingency case moving from one firm to another when the client discharges the first firm without cause. See, e.g. Lai Ling Chengv.Modansky Leasing Co., 73 N.Y.2d 454, 457-58 (1989) (citing In re Montgomery’s Estate, 272 N.Y. 323, 326-27 (1936)) (“When a client discharges an attorney without cause, the attorney is entitled to recover compensation from the client measured by the fair and reasonable value of the services rendered whether that be more or less than the amount provided in the contract or retainer agreement”); Tillmanv.Komar, 259 N.Y. 133,135-36 (1932) (“On the termination of the contract of retainer a cause of action for the reasonable value of his services immediately accrued to the attorney,” determined on a quantum meruit basis) (emphasis added); Schneider, Kleinick, Weitz, Damashek&Shoot v. City of New York, 302 A.D.2d 183, 188 (1st Dep’t 2002) (attorney discharged without cause may recover “in quantum meruit for the reasonable value of the services rendered”). As shown below, the same consistency should exist when analyzing the fees due on hourly matters in these two analogous contexts.

6 As suggested above, the argument that the first firm may keep all the “profits” on an hourly fee matter even if the majority of the work is done at the subsequent firm stands in stark contrast to how hourly fees would be divided in any other context. Normally, if an attorney moves from one firm to another, the attorney gives his or her clients an option to stay at the first firm or move to the new one. If the client decides to move, the client pays the first firm through the date the latter is discharged as counsel, and the new firm bills for all subsequent time. The hourly case is thus not viewed as an “asset” of the first firm, for which the first firm is entitled to subsequently- earned “profits” or any compensation for services rendered by a different law firm. Neither the Thelen Estate, the Coudert court, or any of the other authorities in this area cites a single New York case to the contrary. Nor do they explain why, from the client’s standpoint, a special rule altering the very nature of the attorney-client relationship should apply to hourly cases in the dissolution context – especially when, as shown above, no such special rule applies to contingent cases.

7 The impact of declaring a client-lawyer relationship to be “property” of a lawyer’s firm would be far-reaching. It would eviscerate this Court’s decision in Cohen, discussed below, which prohibits law firms from using financial disincentives to control where lawyers may relocate. Further, it would alter the long-standing view of this Court that clients have the ultimate authority to fire their lawyers, and may do so at any time. See Martin, 219 N.Y. 170. Thus, if client relationships are truly law firms’ “property,” then law firms, not clients, would have the sole power to terminate those relationships. The short of it is that the Coudert and Thelen Estates seek to reverse the relationship between clients and their lawyers by converting lawyers from agents and fiduciaries, obligated to do their clients’ bidding (within ethical limits), into principals who would control clients and their matters.

8 Given the special trust clients place in attorneys and the unique ethical rules that govern that relationship, partnership cases in the context of non-legal professionals are not relevant to this analysis, because legal engagements have unique attributes. Thus, for example, Judge McMahon’s reliance in the Coudert decision on a New York case addressing architects, Stemv. Warren, 227 N.Y. 538 (1920), is misplaced. Development Specialists, 480 B.R. at 161-62; see Geron, 476 B.R. at 741-42 (distinguishing Stem on this basis).

9 The Coudert court made a point that parties could avoid the harsh consequences of the unfinished business doctrine by including a so-called Jewel waiver in their partnership agreement. In such a waiver, the partners agree that the Jewel doctrine would not apply to them and their cases upon dissolution. 156 Cal.App.3d. at 175. But a Jewel waiver does not necessarily solve the problem. Given that the goal here is to protect a client’s right to choose counsel, achieving that goal should not depend on whether the law firm had the foresight to deploy a Jewel waiver. And foresight is indeed required: the waiver has to be put in place well in advance of dissolution in order to avoid being considered a fraudulent transfer. See In re Heller Ehrman LLP, Bankr. No. 08-325154, 2013 WL 951706 at *7-9 (N.D. Cal. March 11, 2013) (disallowing Jewel waiver included in dissolution plan as fraudulent transfer, and citing two-year rule); In re Brobeck, Phleger & Harrison LLP, 408 B.R. 318, 338-40 (N.D. Cal. 2009) (disallowing Jewel waiver as fraudulent transfer). Moreover, as a practical matter, firm managers are often reluctant to raise with their partners the possibility of adding a Jewel waiver to a law firm’s partnership agreement, given their concern that doing so will spread fear about the firm’s viability inside and outside of the firm.

10 The Coudert court engages in circular reasoning when it states that Cohen and Denburg – and by extension RPC 5.6(a), the predecessor of which (DR 2-108(a)) formed the doctrinal basis for those decisions – must give way before the unfinished doctrine because the latter is “set by statute” Development Specialists, 480 B.R. at 171. This would only be true if this Court decides that an hourly legal fee case is a firm asset for purposes of the Partnership Law. It thus assumes the conclusion this Court must decide.

11 The only stated exception involves situations where withdrawal requires permission of a tribunal, in which case the attorney may only withdraw if and when such permission is granted. Rule 1.16(d).

12 Rule 1.16(e) provides:

Even when withdrawal is otherwise permitted or required, upon termination of representation, a lawyer shall take steps, to the extent reasonably practicable, to avoid foreseeable prejudice to the rights of the client, including giving reasonable notice to the client, allowing time for employment of other counsel, delivering to the client all papers and property to which the client is entitled, promptly refunding any part of a fee paid in advance that has not been earned and complying with applicable laws and rules.